Top 10 Budget-Friendly Ways to Personalize Your Car

Car accessories are a thing that improves the functionality and functionality of the car. However, selecting the ideal accessory for your vehicle isn't an easy task. These are five essential car decoration accessories you could think about using for your vehicle.

Read More

Best 10 tips for reducing fuel consumption?

A fuel-efficient car will be great for the environment & your pockets. But, even the most economical cars can be a bit too thirsty if not operating correctly. So, it would help if you also considered your driving style and certain habits to reduce fuel consumption. Here are the 10 tips to make you a pro at improving fuel economy.

Read More

How mileage tracker app helpful for uber & lyft drivers

Here's John, our average rideshare driver from the US. He earns $0.95/mile when he rideshares as an Uber partner or a Lyft driver. A full-time Lyft or Uber driver can easily put nearly about 1,000 miles a week. Which makes it almost 50,000 miles every year. Now, these numbers can vary significantly between drivers.

Read More

What everyone ought to know about Mileage tracker for Tax-deduction?

Are you on business trips too often? Do you spend too many hours calculating the miles you drive and the fuel costs for tax reimbursement? If yes, you are on the right spot! We will let you in on the most beneficial part of using the mileage tracker app, and you can thank us later. Haven’t heard of Mileage tracker before?

Read More

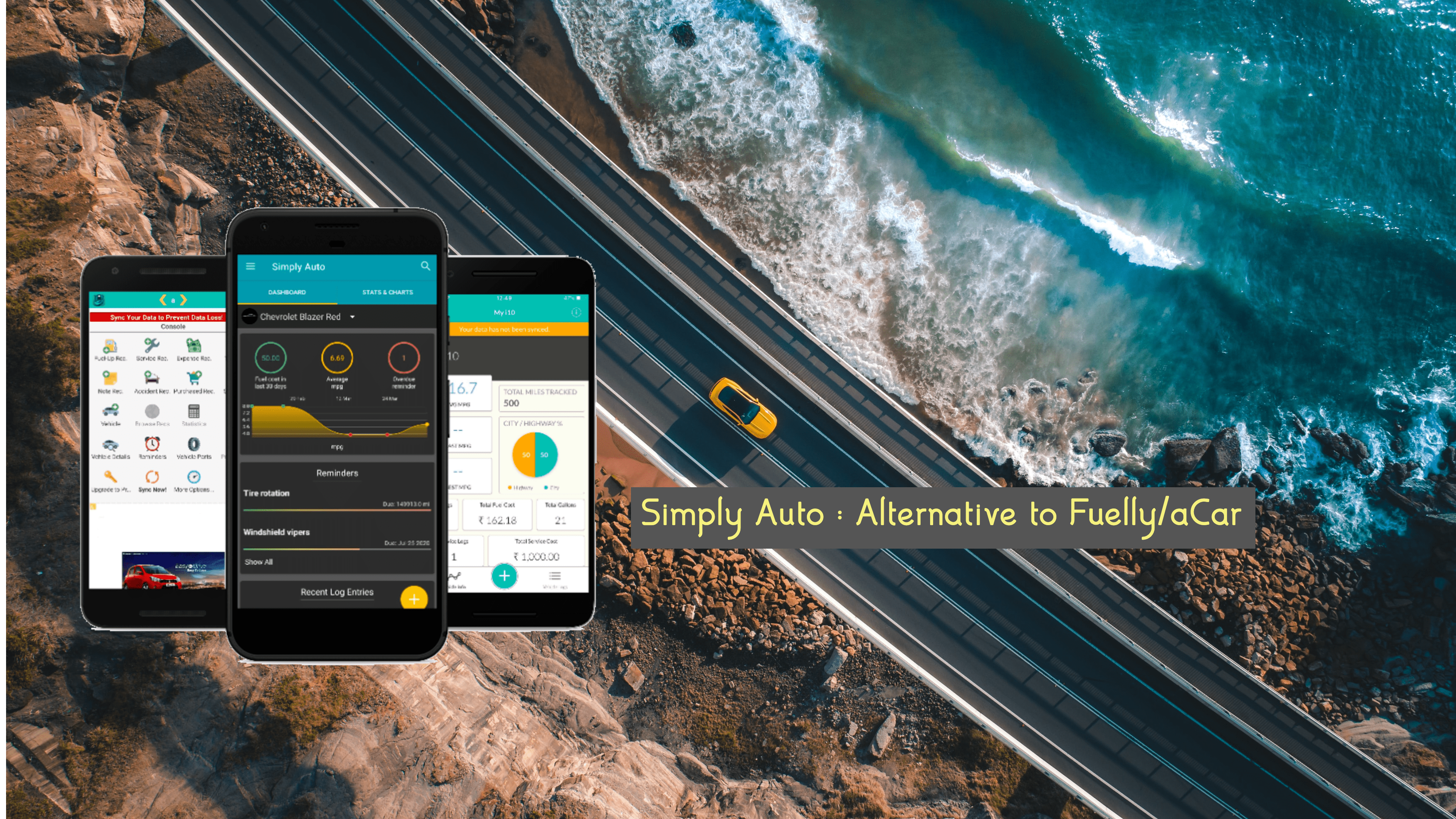

Apply these 6 secret techniques to improve your car maintenance with an app

Regular maintenance of your vehicle not only ensures a longer life for your car but also a hassle-free journey with your car. Car maintenance is a massive problem in today’s life as nobody has the time to make sure the vehicle doesn’t have any significant issues, or to find out if the mechanic is overcharging you for a minute issue.

Read More

Caring for your car

If you drive a car, there's a good chance you only think about two things when operating your vehicle.

What's traffic going to be like on the way to my destination?

Will I need to stop and fill up with gas on the way?

Beyond that, not much else enters most people's minds when thinking about their primary source of transportation. Until, of course,something goes wrong.

How Simply Auto helps self employed in saving money

Self-employed individuals qualify for various tax deductions, including deductions for the business use of their car. If you are self-employed or know anyone who is, then keep reading and we will tell you how you can go about claiming this money. If you are eligible, you might end up with a substantial tax break. Let's find out.

Read More

How to plan for Road Trips

A road trip is an excuse to get away from the mundane life, say hello to a great adventure, a reason for friends and family to hit the road, spend time together and have lots of fun. Sounds exciting, isn't it? But before going on the road one should have a Road trip plan because sometimes having no plan or a bad plan can ruin the whole trip.

Read More

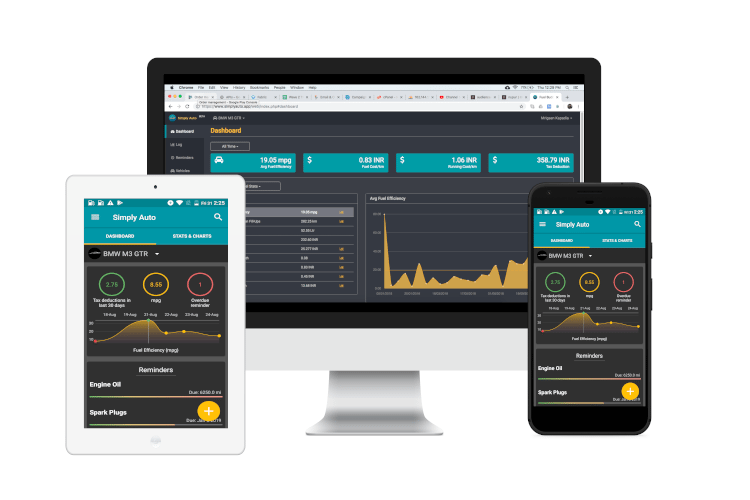

Importance of keeping a vehicle log book app

We all depend on our car/vehicle to take us places safely and securely for work or to run errands. A reliable car is a valuable asset for every individual. Hence, whether you're a professional fleet manager or simply a car owner, a vehicle logbook is crucial for everyone.

Read More